The Bank of America California and Florida Agreement was negotiated by Lainey Feingold and Linda Dardarian using Structured Negotiations on behalf of the California Council of the Blind (CCB) and several individual blind advocates. The Disability Rights Education & Defense Fund (DREDF) also represented the Claimants.

This was the first agreement in the country in which a bank committed to make its website accessible, and the first in which a bank committed to install Talking ATMs in more than one state. This was the first of three agreements involving Bank of America’s services for blind customers. The interim Bank of America national agreement and the final Bank of America national agreement are posted in the Settlement Agreement Category.

Simplified Summary of this Document

SETTLEMENT AGREEMENT

This Settlement Agreement (”Agreement”) is entered into this 14th day of March, 2000 (”Effective Date”) by and between the following parties: Don Brown, Nicaise Dogbo, Bernice Kandarian, Jerry Kuns, Roger Petersen and California Council of the Blind (hereafter “Claimants”) and Bank of America, N. A. and Bank of America Corporation (”Bank of America”) for the purposes and on the terms specified herein and operates in conjunction with the Confidential Addendum to this Agreement.

RECITALS

This Agreement is based on the following facts:

- A.

- Each of the individual Claimants is an individual who is blind or vision-impaired and who currently has, had, or would like to have one or more bank accounts with Bank of America or would like to use Bank of America Automated Teller Machines (”ATMs”) via a network system. Each of the individual Claimants is an individual with a disability within the meaning of Section 3(2) of the Americans with Disabilities Act of 1990, 42 U.S.C. §§ 12101, 12102(2) (”ADA”) and the Title III regulations implementing the ADA contained in 28 C.F.R. §§ 36.101, et seq. (”ADA Regulations”).

- B.

- California Council of the Blind (”Council”) is a non-profit corporation that provides advocacy services on behalf of blind and vision-impaired persons in the State of California, is dedicated to promoting the well-being of blind and vision-impaired persons, and provides information to the general public about the accomplishments, needs and contributions of blind and vision-impaired persons. Council is incorporated and has its place of business in the State of California. Among Council’s members, and those on whose behalf it advocates and provides services, are many individuals with disabilities who hold bank accounts with Bank of America or who hold or held bank accounts with other banks and would like to utilize Bank of America Automated Teller Machines to access those accounts.

- C.

- Bank of America does business in California, in Florida and in other states across the United States. As of the Effective Date, Bank of America does business in these locations under the names Bank of America and NationsBank. Bank of America provides printed material to its customers and potential customers and makes available numerous Automated Teller Machines throughout its franchise.

- D.

- A dispute has arisen between Claimants on one side and Bank of America on the other side, concerning whether Bank of America provides Claimants and other blind and vision-impaired persons with legally required access to its printed materials and ATMs (”the Dispute”).

- E.

- The parties enter into this Agreement in order to resolve the Dispute and to avoid the burden, expense, and risk of potential litigation. In entering into this Agreement, Bank of America does not admit, and specifically denies, that it has violated or failed to comply with any provisions of the ADA, any applicable laws of any state relating to accessibility for persons with disabilities to public accommodations, any regulations or guidelines promulgated pursuant to those statutes, or any other applicable laws, regulations, or legal requirements. Neither this Agreement, nor any of its terms or provisions, nor any of the negotiations connected with it, shall be construed as an admission or concession by Bank of America of any such violation or failure to comply with any applicable law. Neither this Agreement, nor any of its terms or provisions, nor any of the negotiations connected with it, shall be construed as an admission or concession by Claimants with respect to technology, the requirements of any applicable law or Bank of America’s compliance with such applicable law. This Agreement and its terms and provisions shall not be offered or received as evidence for any purpose whatsoever against Bank of America or any Bank of America Parties as that term is defined in the Confidential Addendum, in any action or proceeding, other than a proceeding to enforce the terms of this Agreement.

NOW, THEREFORE, the Parties hereby agree to the following provisions:

1. Definitions

- As used in the Full Agreement, the following terms shall be as defined below:

- 1.1

- Americans with Disabilities Act or ADA means the Americans with Disabilities Act of 1990, 42 U.S.C. § 12101, et seq., and the Title III implementing regulations, 28 C.F.R., Part 36, including Appendix A, the Standards for Accessible Design (hereinafter “Standards”).

- 1.2

- Automated Teller Machine Location or ATM Location means a “location” as that term is used as of the Effective Date in the ATM Locator page of Bank of America’s website, whose current website URL is www.bankofamerica.com, except in the following circumstances:

- 1.2(a) If a single street address is a large public facility (such as an airport, stadium or shopping mall) and is identified by the Locator as constituting one location but has Bank of America ATMs in more than one area, each area containing a Bank of America ATM is an Automated Teller Machine Location.

- 1.3

- Auxiliary Aids and Services means qualified readers, taped texts, audio recordings, Brailled materials, large print materials, or other effective methods of making printed materials available to Persons with Vision Impairments.

- 1.4

- Bank of America Automated Teller Machine or Bank of America ATM means, for the purpose of this Agreement, a self-service, card accessed electronic information processing device that dispenses cash and/or accepts deposits, is owned, leased or operated by Bank of America, installed in public locations for the primary purpose of conducting certain financial and/or other transactions directly through the device, and identified with either the Bank of America or NationsBank name (or any name which Bank of America might in the future adopt as a brand name for its ATMs). Excluded from the foregoing definition are ATMs that the Bank leases to another person or entity, where the Bank does not administer the performance of the ATM and where either the Bank does not own the ATM or any ownership interest of the Bank is solely to secure repayment of a debt owed to the Bank.

- 1.5

- Bank of America Talking ATM means a Bank of America ATM that enables Persons with Vision Impairments to independently access all Functions on the ATM that are available to sighted persons and that are required to be accessible pursuant to the terms of this Agreement. A Bank of America Talking ATM has the following features: (1) speech output with volume control, subject to the provisions relating to volume control set forth in section 3.1(a) below; (2) Tactilely Discernible Controls; (3) ensures the privacy of the audible output of information; (4) provides the same degree of privacy of user input as is provided to sighted users; (5) allows the user to review and correct entries without canceling the entire transaction to the same extent that sighted users of the ATM can so review and correct entries for the particular transaction; (6) provides audible transaction prompts to enable completion of each Function required to be accessible pursuant to this Agreement; (7) provides audible operating instructions and orientation to machine layout; (8) allows the user to interrupt audible instructions; (9) repeats audible instructions, and (10) provides audible verifications for all inputs, except that entry of the personal identification number need not be verified audibly with numbers. When the method for ensuring privacy is an earphone, the earphone jack will be placed in an easily locatable position and will be a standard, 3.5 millimeter size.

- 1.6

- Bank of America 24-Hour Telephone Customer Service means the toll-free telephone banking customer service that Bank of America provides to its consumers 24 hours per day for conducting banking transactions and obtaining information about accounts, products and services.

- 1.7

- Counsel means Saperstein, Goldstein, Demchak & Baller, The Law Office of Elaine B. Feingold, The Disability Rights Education & Defense Fund, Inc., and the attorneys practicing law therein.

- 1.8

- Existing ATM Locations means all Bank of America ATM Locations existing as of the Effective Date.

- 1.9

- Function means a task or transaction that an ATM is capable of performing. Examples of ATM Functions available on Bank of America ATMs as of the Effective Date include the ability to dispense cash, accept deposits, provide account balance information before and after a transaction, and transfer money between multiple accounts.

- 1.10

- Model Bank Platform means the ATM system currently in use to operate Bank of America ATMs in east or central States in the United States, but not California, Washington, Oregon or Idaho; or any system that replaces it.

- 1.11

- Model Bank Target Web Environment means the consolidated Bank of America website that will exist upon completion of all NationsBank/Bank of America product conversions and implementation of website content and tools reflecting the combined bank’s nationwide product set. The website URL is “www.bankofamerica.com”.

- 1.12

- Persons with Vision Impairments means individuals who are blind or have central visual acuity not to exceed 20/200 in the better eye, with corrected lenses, as measured by the Snellen test, or visual acuity greater than 20/200, but with a limitation in the field of vision such that the widest diameter of the visual field subtends an angle not greater than 20 degrees.

- 1.13

- Rollout Locations means Existing ATM Locations and Subsequently Acquired ATM Locations, and does not include ATM Locations where Talking ATMs are deployed during Pilot Projects.

- 1.14

- Subsequently Acquired ATM Locations means ATM Locations that are added to the ATM Locator page of Bank of America’s website for the first time after the Effective Date, using the criteria and timing for adding ATM Locations to the ATM Locator Page in effect as of the Effective Date.

- 1.14(a) If an added ATM Location is a single street address comprising a large public facility (such as an airport, stadium or shopping mall) and is identified by the Locator as constituting one location but has Bank of America ATMs in more than one area, each area containing a Bank of America ATM will be a Subsequently Acquired Automated Teller Machine Location.

- 1.15

- Tactilely Discernible Controls means operating mechanisms used in conjunction with speech output that can be located and operated by feel. When a numeric keypad is part of the Tactilely Discernible Controls used on a Bank of America Talking ATM, all Function keys will be mapped to the numeric keypad and the numeric keypad will have an “echo” effect such that the user’s numeric entries are repeated in voice form, except for the entry of a personal identification number. Additionally, all Tactilely Discernible Controls will otherwise comply with applicable regulations.

2. Duration and Geographic Scope of Agreement.

This Agreement shall apply to Bank of America’s provision of ATM services and printed materials in every State in the United States in which Bank of America does business in the areas of ATM services, deposit accounts and/or consumer lending. The terms of this Agreement shall remain in effect from the Effective Date to six months after the completion of the Rollout Programs described in section 3, below or in any Addendum hereto.

3. Talking ATMs.

- 3.1 Deployment of Bank of America Talking ATMs in California.

- 3.1(a) Development and Testing. Commencing within ten (10) days of the Effective Date, Bank of America, in conjunction with its principal ATM vendor for California, will begin developing and testing, in a controlled laboratory setting, Bank of America Talking ATMs. Because of unique circumstances surrounding the implementation of the Model Bank Platform in California currently scheduled to take place in the third quarter of 2001, the Bank of America Talking ATMs that will be developed, pilot tested and rolled out during Phase I of the California rollout described in section 3.1(d) below will provide Persons with Vision Impairments independent access to the following Functions, to the extent that such Functions are available to sighted persons at the ATM Location where the pilot Talking ATM is to be installed: (i) transfers between a user’s accounts; (ii) deposits to a user’s accounts (iii) cash withdrawals from a user’s accounts; and (iv) cash withdrawals from a user’s credit card account when the ATM is accessed through the user’s credit card. The parties recognize that Bank of America’s principal ATM vendor for California may not have ready the volume control feature (described in section 1.5(1) above) for the California Talking ATM Development and Testing phase or Pilot Project. Bank of America will inform Claimants of the status of this feature at the meetings required by section 3.1(c) herein and will incorporate this feature into Bank of America Talking ATMs promptly after its becoming available from the ATM vendor.

- 3.1(b) California Pilot Project. At the conclusion of the Development and Testing phase, but no later than May 31, 2000, Bank of America will install Bank of America Talking ATMs as described in Section 3.1(a) of this Agreement at a minimum of fifteen (15) Existing Bank of America ATM Locations for pilot testing. During the California Pilot Project, Bank of America will solicit input from Persons with Vision Impairments. To the extent such input is received by means of electronic communications from Persons with Vision Impairments through Bank of America’s web site, or by means of telephone communications from Persons with Vision Impairments through the Bank of America 24-Hour Telephone Customer Service, Bank of America will record such input on standard forms created by Bank of America, relevant information from which shall be provided to Claimants upon reasonable request therefor, subject to the condition that Bank of America will not provide information subject to any restrictions relating to rights of privacy or confidentiality. In the event Claimants seek information that the Bank contends is subject to restrictions relating to rights of privacy or confidentiality, Claimants may invoke the procedures of sections 9.1(b) through 9.4 of this Agreement. To the extent Persons with Vision Impairments evince a desire to provide input at an Existing Bank of America ATM Location where a Talking ATM has been installed and which is staffed by Bank of America personnel, such personnel will be instructed to direct such Persons with Vision Impairments to the nearest telephone connecting to the Bank of America 24-Hour Telephone Customer Service.

- 3.1(c) During the Development and Testing phase and Pilot Project, Bank of America personnel will meet with representatives of Claimants at least once every sixty (60) days to demonstrate and report on the progress of these efforts and to elicit input regarding the operation, usability and flow of the Talking ATM. Bank of America will consider Claimants’ comments pursuant to Section 3.8 below.

- 3.1(d) California Rollout Program – Phase I. At the conclusion of the California Pilot Project, but no later than September 1, 2000, Bank of America will begin Phase I of the California Rollout Program. Phase I will be completed by September 1, 2001. During Phase I of the California Rollout Program, Bank of America will install one Bank of America Talking ATM as described in Section 3.1(a) above, at two hundred and fifty (250) Existing and/or Subsequently Acquired ATM Locations (hereinafter “Rollout Locations”). The Phase I California Rollout shall be completed pursuant to the following schedule:

-

ATM Rollout Dates/Location Schedule Date (No Later Than) Number of Rollout Locations With Enhanced ATMs September 1, 2000 25 Rollout Locations March 31, 2001 125 Rollout Locations September 1, 2001 250 Rollout Locations - 3.1(e) California Rollout Program – Phase II.

- 3.1(e)(1) Functions of the Talking Automated Teller Machines Installed During Phase II. The Bank of America Talking ATMs that will be rolled out during Phase II of the California Rollout Program will provide Persons with Vision Impairments independent access to the following Functions, to the extent that such Functions are available to sighted persons at the Rollout Location: (i) account balance; (ii) transfers between a user’s accounts; (iii) deposits to a user’s accounts; (iv) cash withdrawals from a user’s accounts; (v) cash withdrawals from a user’s credit card account when the ATM is accessed through the user’s credit card; and (vi) any other Functions required to be available on Bank of America Talking ATMs pursuant to sections 3.2(a)(1) and 3.2(a)(2) below.

- 3.1(e)(2) Schedule. Phase II of the California Rollout Program shall begin on the earlier of the following two dates: (a) September 30, 2001 or (b) thirty (30) days after installation of the Model Bank Platform in California. Bank of America shall inform Claimants in writing within five (5) days of the date of installation of the Model Bank Platform in California. During Phase II of the California Rollout Program, Bank of America will install one Bank of America Talking ATM, as described in Section 3.1(e)(1), at each Rollout Location pursuant to the following schedule:

-

ATM Rollout Dates/Location Schedule Date (No Later Than) Percentage of Rollout Locations With Enhanced ATMs December 31, 2001 25% March 31, 2002 40% December 31, 2002 80% June 30, 2003 100% - 3.1(f) Additional Functions for Bank of America Talking ATMs Installed During Phase I of the California Rollout. Talking ATMs installed during Phase I of the California Rollout will be upgraded to provide Persons with Vision Impairments access to account balance information, as follows:

- 3.1(f)(1) Access to account balance information will be added when the Talking ATM at the Phase I ATM Location is serviced or upgraded, unless such access can be added to the ATM by downloading software from the host directly to the ATM.

- 3.1(f)(2) Upgrading Phase I California ATM Locations to include access to account balance information on Bank of America Talking ATMs will begin no later than ninety (90) days after the access to account balance information is included in Talking ATMs at Phase II Rollout Locations.

- 3.2 Deployment of Bank of America Talking ATMs in Florida.

- 3.2(a) Development and Testing.

- 3.2(a)(1) Commencing within sixty (60) days of the Effective Date, Bank of America, in conjunction with its principal ATM vendors, will begin developing and testing, in a controlled laboratory setting, Bank of America Talking ATMs that will provide Persons with Vision Impairments independent access to the following Functions: (i) account balance; (ii) transfers between a user’s accounts; (iii) deposits to a user’s accounts; (iv) cash withdrawals from a user’s accounts; (v) cash withdrawals from a user’s credit card account when the ATM is accessed through the user’s credit card; and (vi) any other Functions available to sighted persons through Bank of America ATMs.

- 3.2(a)(2) If at any time during the Development and Testing phase described in section 3.2(a)(1), Bank of America reasonably believes that there is a Function offered to sighted customers on Bank of America ATMs, other than the Functions set forth in section 3.2(a)(1)(i)-(v), that cannot be made part of the Bank of America Talking ATM because the necessary hardware or software components cannot be obtained from one of Bank of America’s principal vendors or any other United States ATM vendors manufacturing products that are compatible with Bank of America ATMs, Bank of America will notify Claimants in writing, providing written documentation from all applicable vendors. At Claimants’ request, made in writing within ten (10) days after receiving Bank of America’s written notification, Bank of America will use its best efforts to arrange for a meeting to be held with Claimants, Bank of America and its applicable ATM vendors regarding any Function that is the subject of the written notice. If the parties cannot agree within ten (10) days of receipt of the notice, or, if a meeting is held, within ten (10) days of the meeting, as to whether the disputed Function should be part of the Bank of America Talking ATM, Claimants may submit to binding arbitration, pursuant to section 9.4 below, the question of whether or not the necessary hardware or software components can be obtained from an applicable vendor that would enable the Function to be included on the Bank of America Talking ATM.

- 3.2(b) Florida Pilot Project. At the conclusion of the Development and Testing phase, but no later than November 30, 2000, Bank of America will install Bank of America Talking ATMs as described in section 3.2(a)(1) and (a)(2) at a minimum of fifteen (15) Existing and/or Subsequently Acquired Bank of America ATM Locations in Florida. During the Florida Pilot Project, Bank of America will solicit input from Persons with Vision Impairments. To the extent such input is received by means of electronic communications from Persons with Vision Impairments through Bank of America’s web site, or by means of telephone communications from Persons with Vision Impairments through the Bank of America 24-Hour Telephone Customer Service, Bank of America will record such input on standard forms created by Bank of America, relevant information from which shall be provided to Claimants upon reasonable request therefor, subject to the condition that Bank of America will not provide information subject to any restrictions relating to rights of privacy or confidentiality. In the event Claimants seek information that the Bank contends is subject to restrictions relating to rights of privacy or confidentiality, they may invoke the procedures of sections 9.1(b) through 9.4 of this Agreement. To the extent Persons with Vision Impairments evince a desire to provide input at an Existing Bank of America ATM Location where a Talking ATM has been installed and which is staffed by Bank of America personnel, such personnel will be instructed to inform such Persons with Vision Impairments of the Bank of America 24-Hour Telephone Customer Service number.

- 3.2(c) During the Development and Testing phase and Pilot Project described in sections 3.2(a) and (b) above, Bank of America personnel will meet or confer with representatives of Claimants at least once every sixty (60) days to demonstrate and report on the progress of these efforts and to elicit input regarding the operation, usability and flow of the Bank of America Talking ATM. Bank of America will consider Claimants’ comments, pursuant to section 3.8 below.

- 3.2(d) Florida Rollout Program. At the conclusion of the Florida Pilot Project, but no later than March 31, 2001, Bank of America will begin the Florida Rollout Program. During the Florida Rollout Program, Bank of America will install one Bank of America Talking ATM as described in sections 3.2(a)(1) and 3.2(a)(2) at each Rollout Location pursuant to the following schedule:

-

ATM Rollout Dates/Location Schedule Date (No Later Than) Number or Percentage of Rollout Locations With Enhanced ATMs March 31, 2001 50 Rollout Locations September 1, 2001 250 Rollout Locations March 31, 2002 40% December 31, 2002 75% June 30, 2003 100% - 3.3 Deployment of Talking ATMs in Remaining States Where Bank of America Does Business.

- 3.3(a) On a date between March 1, and March 31, 2001, to be agreed upon by the Parties, the Parties shall begin negotiating in good faith regarding the schedule for installing Bank of America Talking ATMs in the remaining states where there are Bank of America ATM Locations or Subsequently Acquired ATM Locations. The Talking ATMs to be rolled out in the remaining states will be the machines developed, tested and piloted in Florida except as provided in section 3.4 herein. Such negotiations shall continue for a period not to exceed sixty (60) days (”Negotiation Period”).

- 3.3(b) If the Parties reach agreement on the rollout schedule for the remaining states within the Negotiation Period, that agreement will be memorialized in writing as an Addendum to this Agreement.

- 3.3(c) If the Parties have not reached agreement on the rollout schedule for the remaining states by the conclusion of the Negotiation Period, and if the parties have not agreed to an extension of the Negotiation Period, the issue of an appropriate schedule for installing Bank of America Talking ATMs in the remaining states where there are Bank of America ATM Locations or Subsequently Acquired ATM Locations will be submitted to binding arbitration pursuant to section 9.4, below.

- 3.4 New and Previously Excluded Functions on Bank of America Talking ATMs.

- The following provisions apply to (i) a Function that did not exist for sighted persons on any Bank of America ATM at the time that the Talking ATM for Florida was developed and tested (hereafter “New Function”), and (ii) any Function on a Bank of America ATM that is available to sighted persons and was not included as part of the Bank of America Talking ATM pursuant to section 3.2(a)(2) for which the necessary hardware or software components are subsequently obtainable from one of Bank of America’s principal vendors or any other United States ATM vendors manufacturing products that are compatible with Bank of America ATMs (hereinafter “Previously Excluded Function”).

- 3.4(a) Subject to section 3.4(b), all New and Previously Excluded Functions will be added to Bank of America Talking ATMs as follows:

- 3.4(a)(1) The New or Previously Excluded Function will be included on all Bank of America Talking ATMs that have not yet been rolled out, provided that the Function is available to sighted persons at the Rollout Location;

- 3.4(a)(2) The New or Previously Excluded Function will be included on all previously rolled out Talking ATMs, provided that the Function is available to sighted persons at the Rollout Location, whenever the Talking ATM at the Location is serviced or upgraded, unless the Function can be added to the ATM by downloading software from host directly to the ATM Location, in which case the New or Previously Excluded Function shall be added when the download becomes possible.

- 3.4(b) Proviso Regarding New Functions. If Bank of America reasonably believes that a New Function cannot be made part of the Bank of America Talking ATM because the necessary hardware or software components cannot be obtained from one of Bank of America’s principal vendors or any other United States ATM vendors manufacturing products that are compatible with Bank of America ATMs, or because it would have a substantial adverse effect on the individual performance of a substantial number of such ATMs or on the overall performance or security of Bank of America’s ATM operations, or because the available technology would not permit Bank of America to develop and install Bank of America Talking ATMs that will operate effectively to enable Persons with Vision Impairments to independently use the machines for such New Function, Bank of America will notify Claimants in writing, providing written documentation from all applicable vendors. At Claimants’ request, made in writing within ten (10) days after receiving Bank of America’s written notification, Bank of America will use its best efforts to arrange for a meeting to be held with Claimants, Bank of America and its applicable vendors regarding any Function that is the subject of the written notice. If the parties cannot agree within ten (10) days of receipt of the notice, or, if a meeting is held, within ten (10) days of the meeting, as to whether the disputed Function should be part of the Bank of America Talking ATMs, Claimants may submit to binding arbitration, pursuant to section 9.4, below, the question of whether or not the necessary hardware or software components can be obtained from an applicable vendor that would enable the Function to be included on the Bank of America Talking ATM, or whether inclusion of such Function would have a substantial adverse effect on the individual performance of a substantial number of such ATMs or on the overall performance or security of Bank of America’s ATM operations, or whether the available technology would permit Bank of America to develop and install Bank of America Talking ATMs that will operate effectively to enable Persons with Vision Impairments to independently use the machines for such New Function.

- 3.5 Locations with Different Types of Bank of America ATMs.

- Except during Phase I of the California Rollout, whenever a Bank of America Rollout Location has multiple Bank of America ATMs, the Bank of America Talking ATM at that Location shall have the same Functions as the Bank of America ATM with the greatest number of Functions at that Location, except as otherwise provided in sections 3.4(a) and 3.4(b). In addition, whenever a Bank of America Rollout Location has multiple ATMs with varying hours of operation, the Bank of America Talking ATM shall have the same hours of operation as the ATM with the longest hours of operation.

- 3.6 Subsequently Relinquished ATM Locations.

- If Bank of America ceases to own, operate or lease an ATM Location after the Effective Date, that ATM Location shall no longer be subject to this Agreement as of the date upon which Bank of America ceases to own, operate or lease the ATM Location, and such Subsequently Relinquished ATM Locations shall no longer be considered in calculating Bank of America’s rollout schedules unless the ATM Location is relinquished to a parent or successor of Bank of America, in which case the ATM Location remains subject to this Agreement.

- 3.7 Pilot and Rollout Locations.

- Bank of America and Claimants will jointly agree to the Bank of America ATM Locations at which Talking ATMs will be installed in California and Florida during the Pilot Projects and the first six months of the Rollout Programs.

- 3.8 Comments.

- Bank of America shall consider all written comments given by Claimants pursuant to Sections 3.1(c) and 3.2(c), above, provided that such comments and suggestions are consistent with this Agreement and the ADA, and provided further that such comments are communicated by Counsel in writing on behalf of all parties and representatives within ten (10) business days after the demonstration or meeting which gives rise to the comments. Within ten (10) business days after receipt of any such comments, Bank of America shall provide Counsel with a specific response in writing regarding Bank of America’s position on each such comment.

- 3.9 Provision of Information to Claimants.

- 3.9(a) Twice annually during the pendency of this Agreement, beginning six months after the Phase I of the California Rollout Program commences, Bank of America will provide to Counsel in writing the following information (if applicable during the reporting period) about the Rollout Programs:

- 3.9(a)(1) the number and address of each Bank of America Talking ATM placed during each reporting period;

- 3.9(a)(2) the number of ATM Locations in California, and, after the Florida Pilot Project has commenced, the number of ATM Locations in Florida. Information regarding the number of ATM locations in other states will be provided consistent with the schedule agreed upon during the negotiations described in section 3.3(a) of this Agreement;

- 3.9(a)(3) a list of any New Functions, as defined in section 3.4.

- 3.9(b) Within ten (10) days of receiving the information required pursuant to Section 3.9(a) above, Claimants may request additional information reasonably related to implementation of this Agreement. Within thirty (30) days of Claimants’ request, Bank of America shall provide such information to Claimants or state objections to same in writing.

- 3.10 Visual and Tactile Signage.

- Each Bank of America Talking ATM installed pursuant to this Agreement shall have a sign that identifies the machine as a Talking ATM. Any text in that sign shall be in large print and Braille. Any non-text symbol on the sign shall be tactile. Additionally, each Non-Talking ATM at Talking ATM Locations shall have a sign in Braille stating that there is a Talking ATM at that Location.

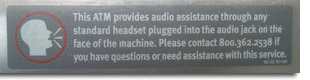

- 3.11 Availability of Private Listening Devices.

- Any private listening devices necessary to utilize any Bank of America Talking ATM shall be readily available and provided free of charge to Persons with Vision Impairments.

- 3.12 Maintenance of Talking ATMs.

- Bank of America will maintain its Talking ATMs in operable working condition at all times except for isolated or temporary interruptions in service due to maintenance or repairs. Should a Talking ATM malfunction, Bank of America will use best efforts to correct the problem within 24 hours of receiving notice of the malfunction.

- 3.13 Braille Labels at Bank of America ATM Locations.

- All Bank of America ATMs (Talking and Non-Talking) in California will have Braille labels identifying all Function keys and deposit slots. Additionally, Talking ATMs in all states where Talking ATMs are installed will have Braille labels identifying the earphone jack. The use of Braille labels for ATMs other than those described in the preceding provisions of this section 3.13. will be negotiated between the Parties in the course of the negotiation described in section 3.3(a).

4. Web Accessibility.

- 4.1

- Bank of America will use its best efforts to design each page of the Model Bank Target Web Environment so that it complies with Priorities One and Two of the Web Content Accessibility Guidelines found at www.w3c.org, or so that it is otherwise accessible to Persons with Vision Impairments.

- 4.2

- Within thirty (30) days of the Effective Date, Bank of America will hire a mutually agreed upon consultant to assist Bank of America in meeting its obligation pursuant to section 4.1. Claimants shall provide Bank of America with the names of potential consultants within five (5) days of the Effective Date. The consultant will be required to execute a consulting agreement to be prepared by Bank of America and a confidentiality agreement to be prepared by Bank of America regarding web accessibility at Bank of America. The consultant’s contract with Bank of America shall continue through the term of this Agreement unless otherwise agreed to by the Parties. The confidentiality agreement shall not preclude the consultant from sharing with Claimants information relevant to Bank of America’s compliance with section 4.1.

- 4.3

- The mutually agreed upon consultant shall be provided all relevant information reasonably necessary to provide assistance to Bank of America as set forth above.

- 4.4

- Subject to reasonable terms set forth in the consulting agreement, twice annually during the term of this Agreement, the consultant shall report to Bank of America and Claimants regarding Bank of America’s progress toward compliance with section 4.1 above. Within two weeks of receipt of such report, Claimants may request additional information regarding the content of the report, provided that such information is relevant to Bank of America’s compliance with section 4.1.

5. Auxiliary Aids and Services for Printed Material.

- 5.1 Provision of Auxiliary Aids and Services for Printed Material.

- Within one hundred and eighty (180) days of the Effective Date, Bank of America shall implement an Auxiliary Aids and Services Policy and Procedure, pursuant to the terms of this section, to memorialize and enhance Bank of America’s present procedures to ensure that Bank of America’s printed materials are communicated effectively to Persons with Vision Impairments, to the extent required by the ADA.

- 5.2 Development of Auxiliary Aids and Services Policy and Procedure.

- 5.2(a) Within ninety (90) days of the Effective Date, Bank of America will provide Claimants with a copy of a draft Auxiliary Aids and Services Policy and Procedure. Within ten (10) business days after receiving the Auxiliary Aids and Services Policy and Procedure, Claimants shall provide written comments and suggestions about them to Bank of America. Bank of America shall consider and use best efforts to incorporate the substance of all such written comments and suggestions that Claimants give pursuant to this section that are consistent with the ADA and this Agreement.

- 5.2(b) Within one hundred and twenty (120) days of the Effective Date, Bank of America shall finalize the Auxiliary Aids and Services Policy and Procedure.

- 5.2(c) Within one hundred and eighty (180) days of the Effective Date, Bank of America shall commence implementation of the Auxiliary Aids and Services Policy for Persons with Vision Impairments.

- 5.3 Elements of the Auxiliary Aids and Services Policy and Procedure.

- Bank of America’s Auxiliary Aids and Services Policy and Procedure (hereafter “Policy and Procedure”) shall be consistent with the ADA and shall include, at a minimum, the following elements:

- 5.3(a) A Statement of Bank of America’s Obligation to Provide Effective Auxiliary Aids and Services of Its Choice. The Policy and Procedure shall state that, in those States in the United States where Bank of America does business in the areas of ATM services, deposit accounts and/or consumer lending, Bank of America will provide Auxiliary Aids and Services for its print materials in those areas to Persons with Vision Impairments who request Auxiliary Aids and Services in a manner consistent with Section 5.3(d). The Policy and Procedure shall further provide that if more than one Auxiliary Aid or Service is effective to communicate a particular printed material to a Person with Vision Impairment, Bank of America may select the effective method of its choice.

- 5.3(b) A Statement of Printed Materials Covered by the Policy and Procedure. The Policy and Procedure shall state that it applies to all printed materials in the areas of ATM services, deposit accounts and/or consumer lending published by Bank of America and its subsidiaries and made available in any State in the United States in which Bank of America does business in the foregoing areas, and shall list specific examples of materials for which the Bank will provide Auxiliary Aids and Services, including but not limited to monthly account statements, credit card information, informational materials such as product and service brochures, legal disclosure booklets, loan and account applications, special notices of account activity, notices of changes in account terms or conditions, and ATM Guides.

- 5.3(c) A Statement of the Types of Auxiliary Aids and Services Offered. The Policy and Procedure shall list available Auxiliary Aids and Services, including Braille, large print, computer disk, audio tape cassette, agent or operator assisted and self-service 24-Hour Telephone Customer Service, and branch staff assistance. Bank of America’s web site may serve as an Auxiliary Aid and Service at such time as the consultant hired pursuant to section 4.2 herein states in writing that the Model Bank Target Environment complies with Priorities One and Two of the Web Accessibility Guidelines or is otherwise accessible to Persons with Vision Impairments.

- 5.3(d) A Reasonable Method or Methods for Persons with Vision Impairments to Request Auxiliary Aids and Services. The Policy and Procedure shall contain a reasonable method or methods by which Persons with Vision Impairments may request Auxiliary Aids and Services. At a minimum, the Policy and Procedure shall allow Persons with Vision Impairments to request Auxiliary Aids and Services over the telephone or by electronic mail (”e-mail”). The Policy and Procedure shall ensure that Persons with Vision Impairments do not have to request more than once that account statements be provided by means of an Auxiliary Aid or Service.

- 5.3(e) Time Frame Within which Bank of America Must Provide Auxiliary Aids and Services After Receipt of a Request. The Policy and Procedure shall contain reasonable time frames for Bank of America to provide Auxiliary Aids and Services after receiving requests therefore.

- 5.3(f) A Method for a Person with Vision Impairments to Seek, and for Bank of America to Provide, an Auxiliary Aid or Service Other than that Initially Offered by Bank of America. The Policy and Procedure shall provide a method by which Persons with Vision Impairments can seek a particular Auxiliary Aid or Service other than that offered by Bank of America for a particular type of printed material. The Policy and Procedure shall establish a procedure for the Bank to accept or reject such requests within a reasonable time frame. The Policy and Procedure shall not require Bank of America to grant any such request if the Auxiliary Aid and Service initially offered by the Bank is effective to communicate to the Person with Vision Impairment the information provided on the particular document requested.

- 5.3(g) No Charge for Auxiliary Aids and Services. The Auxiliary Aids and Services Policy and Procedure shall state that Bank of America will not impose any fees or charges on Person with Vision Impairments for providing any Auxiliary Aids or Services pursuant to this Agreement.

- 5.4 Fee Waivers.

- Commencing on the Effective Date, Bank of America will waive fees associated with the use of its 24-Hour Customer Service Telephone, live teller assistance and On-Line Banking for Persons with Vision Impairments.

- 5.5 Raised Line Checks.

- Bank of America will provide raised line checks for demand deposit and negotiable order of withdrawal accounts to Persons with Vision Impairments who so request, at a cost not to exceed the cost of the most comparable basic checks.

- 5.6 Limitation on Remedies.

- A breach of section 5 shall occur only where Claimants can establish that Bank of America has engaged in a pattern or practice of non-compliance with section 5. The Parties agree that the fact that a Person with Vision Impairment is dissatisfied with a particular Auxiliary Aid or Service offered by Bank of America shall not constitute a breach of this Agreement. No breach of contract claims related to Bank of America’s provision of Auxiliary Aids and Services under this Agreement may be maintained by persons who are not parties to this Agreement.

- 5.7 Record-Keeping and Reporting.

- To the extent such requests, complaints or compliments are received through Bank of America’s website or 24-Hour Telephone Customer Service, Bank of America will record requests for Auxiliary Aids and Services, the Bank’s response to each such request, and complaints and compliments about Bank of America’s provision of Auxiliary Aids and Services on a form designed for this purpose. Beginning six (6) months from the Effective Date, Bank of America will provide Claimants’ Counsel with semi-annual reports describing and quantifying requests for Auxiliary Aids and Services, listed by banking material and type of Auxiliary Aid or Service requested, and the type of Auxiliary Aid or Service provided in response to each request; and summarizing complaints and compliments received by Bank of America concerning its provision of Auxiliary Aids and Services pursuant to this Agreement.

6. Training of Bank of America Personnel.

- 6.1

- Bank of America will develop a training program and train its employees who serve the public in the areas of deposit accounts and consumer lending in branch locations (including branches located in other retailers’ facilities) or the 24-Hour Telephone Customer Service regarding the use and operation of Talking ATMs and the Auxiliary Aids and Services Policy. Such employees will be trained in a timely manner to ensure effective implementation of the provisions of this Agreement.

- 6.2 Training Consultant.

- Within thirty (30) days of the Effective Date, Bank of America shall hire a mutually agreed upon consultant to assist Bank of America in carrying out its obligations pursuant to section 6.1 above. Bank of America may require such consultant to sign a consulting agreement and/or a confidentiality agreement to be prepared by Bank of America. The consultant will be a Person with Vision Impairments.

- 6.3 Training Materials and Program.

- Bank of America will provide Claimants and Counsel with copies of any training materials, and the principal components of its training plan, thirty (30) days prior to commencing the training required by this Agreement. Claimants shall provide Bank of America with comments thereon within ten (10) days of receipt. Bank of America shall consider and use best efforts to incorporate the substance of all such written comments and suggestions that Claimants give pursuant to this section that are consistent with the ADA and this Agreement.

- 6.4 Training Schedule.

- 6.4(a) Within one hundred and twenty (120) days of the Effective Date, Bank of America shall finalize the training program, and shall commence initial training of its employees who serve the public in the areas of deposit accounts or consumer lending in branch locations (including branches located in other retailers’ facilities) or the 24-Hour Telephone Customer Service regarding implementation of the Auxiliary Aids and Services Policy and Procedure.

- 6.4(b) Within one hundred and eighty (180) days of the Effective Date, Bank of America shall complete initial training of employees described above regarding implementation of the Auxiliary Aids and Services Policy and Procedure.

- 6.4(c) New employees hired after the Effective Date and after the date specified in section 6.4(b), who serve the public at branches in the areas of deposit accounts or consumer lending, or at the 24-Hour Telephone Customer Service shall receive training regarding implementation of the Auxiliary Aids and Services Policy and Procedure. Bank of America shall include annually an article or reminder notice about the Auxiliary Aids and Services Policy and Procedure in a publication circulated to its employees.

- 6.4(d) The training described in this section 6.4 shall include training regarding use, operation and location of Talking ATMs consistent with the schedule and locations for installation of such Talking ATMs.

7. Future Compliance with Statutes, Regulations and Standards.

- 7.1 Effect of Change in Law or Regulation.

- The parties acknowledge that after the Effective Date, standards for access to ATM services by, or the provision of Auxiliary Aids and Services to, Persons with Vision Impairments, which are different from Bank of America’s obligations under this Agreement, may be established by applicable new laws or regulations. In the event of such a change, the parties agree that where the new law or regulation imposes a less rigorous obligation than provided in this Agreement, Bank of America’s compliance with the new law or regulation will constitute compliance with this Agreement, provided that Bank of America follows the procedures set forth in section 7.2, below. Where the law imposes a more stringent obligation than provided in this Agreement, the parties agree that: (1) the new obligation shall be incorporated as a term of this Agreement as soon as reasonably feasible after the new obligation becomes effective; and (2) no action by Bank of America, which is permitted or required by such laws or regulations, shall constitute a breach of this Agreement.

- 7.2 Modification Based on Change of Law or Regulations.

- If any party to this Agreement contends that there is a change in any applicable law or regulation, which will necessitate a modification under section 7.1, that party shall notify counsel for the other parties in writing. The notification will include the way in which the party contends the Agreement should be modified as a result of the change in law or regulation. The proposed modification will become effective thirty (30) days after such notification unless counsel for the other parties object in writing to the proposed modification. In the event of disagreement between the parties over the appropriate modifications to this Agreement as contemplated by this Section, the parties shall meet and confer and shall work together in good faith to resolve the disagreement. Failure to reach agreement during such meet and confer shall be considered a dispute to be resolved pursuant to section 9 of this Agreement.

8. Right to Seek Modification Under Certain Limited Circumstances.

- 8.1

- Pursuant to the terms of section 9, below, Bank of America may seek modification of section 3 of this Agreement if:

- 8.1(a) The development, testing, implementation and rollout of the Bank of America Talking ATMs has a substantial adverse effect on the individual performance of a substantial number of such ATMs or on the overall performance or security of Bank of America’s ATM operations; or

- 8.1(b) The available technology does not permit Bank of America to develop and install Bank of America Talking ATMs that will operate effectively to enable Persons with Vision Impairments to independently use the machines for the Functions provided; or

- 8.1(c) There is a method other than Bank of America Talking ATMs for providing Persons with Vision Impairments independent access to banking services at Bank of America ATMs to the same extent that such access is provided by Bank of America Talking ATMs and that such method can be implemented pursuant to the schedules contained in section 3 of this Agreement or any subsequently negotiated Addendum.

- 8.2

- Suspension of Performance Under Certain Limited Circumstances Following Notice of Modification Pursuant to Section 8.1(a) and 8.1(b). Delivery by Bank of America to Claimants of Notice of Proposed Modification pursuant to section 9.1(a), based upon the conditions stated in sections 8.1(a) or 8.1(b) shall suspend for forty-five (45) days Bank of America’s performance of its executory obligations under the portion of section 3 of the Agreement that Bank of America seeks to modify. Any such suspension shall not constitute a breach of section 3 of this Agreement and shall not excuse Bank of America’s performance during the suspension period of all other portions of the Agreement not affected by the suspension.

9. Procedures in the Event of Disputes or Requests for Modification.

- 9.1 Notice.

- 9.1(a) Notice of Proposed Modification. If Bank of America initially concludes, based upon the exercise of reasonable business judgment and discretion, that the conditions exist under which modification of this Agreement is allowed, as set forth in sections 8.1(a), 8.1(b) or 8.1(c), it shall provide Claimants with a written Notice of Proposed Modification containing the following information:

- 9.1(a)(1) Which conditions set forth in section 8.1(a) or 8.1(b) have occurred or, in the event of a modification pursuant to section 8.1(c), what alternative technology it proposes;

- 9.1(a)(2) The factual basis for Bank of America’s initial conclusion that the conditions in sections 8.1(a), or 8.1(b) have occurred, or, in the event of a modification pursuant to section 8.1(c), the details of the alternative technology and the method by which it provides independent access to ATM Functions required by this Agreement within the time frames set forth herein.

- 9.1(b) Notice of Non-Compliance. If at any time a party believes that the other party has not complied with any provision of this Agreement, that party shall provide the other party with Notice of Non-compliance containing the following information:

- 9.1(b)(1) the alleged act of non-compliance;

- 9.1(b)(2) a reference to the specific provision(s) of the Agreement that are involved;

- 9.1(b)(3) a statement of the remedial action sought by the initiating party;

- 9.1(b)(4) a brief statement of the specific facts, circumstances and legal argument supporting the position of the initiating party.

- 9.2 Meet and Confer.

- Within thirty (30) days of receipt of a Notice provided pursuant to sections 9.1(a) or 9.1(b), Claimants and Bank of America shall informally meet and confer and attempt to resolve the issues raised in the Notice; except that where performance has been suspended pursuant to section 8.2, such meet and confer will be held within ten (10) days.

- 9.3 Informal Discovery.

- As part of the meet and confer process, the parties shall exchange relevant documents and/or other information and engage in informal discovery in an attempt to resolve the issues raised in the Notice given pursuant to section 9.1(a) or 9.1(b). Such informal discovery may include, but is not limited to, interviewing witnesses and experts and exchange of additional information or supporting documentation. Any disagreement about information to be provided shall be handled pursuant to the provisions of this section.

- 9.4 Submission to Binding Arbitration.

- 9.4(a) If the matters raised in a Notice provided pursuant to section 9.1(a) or (b) herein are not resolved within thirty (30) days of the initial meet and confer required by section 9.2, either party may submit the unresolved matters to binding arbitration as set forth herein.

- 9.4(b) Arbitration shall be held before the Honorable Eugene Lynch of JAMS provided that he is available to schedule a hearing on the matter within thirty (30) days of the submission to binding arbitration and to render a written decision on the matter within sixty (60) days of the first hearing date. If Judge Lynch is unavailable, the arbitration shall be held before Judge Daniel Weinstein of JAMS provided he can meet this time schedule. If neither Judge Lynch nor Judge Weinstein are available within the time frame set forth herein, the JAMS arbitration selection procedure shall be utilized.

- 9.4(c) Any performance that has been suspended pursuant to section 8.2 herein and is the subject of a matter submitted to binding arbitration pursuant to this section shall continue to be suspended through the date of the arbitrator’s written decision.

- 9.4(d) Law Governing Interpretation and Application of Agreement. The terms of this Agreement, and the provisions thereof, shall be interpreted and applied pursuant to the ADA, or where the ADA does not provide guidance, pursuant to the laws of the State of California.

10. Notice or Communication to Parties.

Any notice or communication required or permitted to be given to the parties hereunder shall be given in writing by facsimile or email and United States mail, addressed as follows:

To Claimants:

Linda M. Dardarian

c/o Saperstein, Goldstein, Demchak & Baller

300 Lakeside Drive, Suite 1000

Oakland, CA 94612

Fax No.: (510) 835-1417

Elaine B. Feingold

Law Office of Elaine B. Feingold

1524 Scenic Avenue

Berkeley, CA 94708

Fax No.: (510) 548-5508

To Bank of America:

Bank of America, N.A.

Bank of America Corporation

Attn: William G.Raymond

Senior Vice President

1455 Market St., 11 Floor

San Francisco, CA 94103

Fax No.: 415-436-5119

and

Morrison & Foerster

Attn: Arne Wagner, Esq.

425 Market Street

San Francisco, CA 94105-2482

Fax No.: (415) 268-7522

11. Publicity Regarding This Agreement and Its Components.

- 11.1 Information to Bank Customers Regarding Talking ATMs and the Auxiliary Aids and Services Policy.

- 11.1(a) Beginning ten (10) days prior to installation of the first pilot Bank of America Talking ATM, Bank of America will provide information about the location of Bank of America Talking ATMs on the “ATM Locator” page of Bank of America’s website and through the Bank of America 24-Hour Telephone Customer Service. Beginning ten (10) days prior to implementation of the Auxiliary Aids and Services Policy and Procedure, the website and Bank of America 24-Hour Telephone Customer Service shall also include information regarding the existence of the Policy and Procedure, and the method(s) by which Person with Vision Impairments can request Auxiliary Aids and Services.

- 11.1(b) Bank of America shall provide Persons with Vision Impairments with a description of the Auxiliary Aids and Services Policy and Procedure upon request made to branch staff or 24-Hour Telephone Customer Service agents or operators. The Auxiliary Aids and Services Policy and Procedure shall be available in formats that provide effective communication to Persons with Vision Impairments.

- 11.2 Information to Persons with Vision Impairments Regarding Talking ATMs and the Auxiliary Aids and Services Policy.

- Twice annually for the first two years of this Agreement, Bank of America will distribute public service announcements to media and organizations serving Persons with Vision Impairments, in order to publicize the existence of Bank of America Talking ATMs and the Auxiliary Aids and Services Policy and Procedure. Within sixty (60) days of the Effective Date, Claimants shall provide Bank of America with a list of media and organizations to whom the announcement should be distributed. The list shall not include media or organizations that charge a fee for making public service announcements. The content of the public service announcement shall be consistent with this Agreement and subject to Claimants’ prior review and approval.

- 11.3 Joint Press Release to Announce Execution of this Agreement.

- The parties will negotiate a joint press release to be issued as soon as practicable upon execution of the Agreement. If the parties cannot agree on a joint press release, either party may send their own press release, provided that (i) the content is consistent with this Agreement; and (ii) a copy of the release is provided to all parties and their counsel at least twenty-four (24) hours before it is sent to the press.

- 11.4 Joint Press Release and Press Conference to Announce Installation of First Pilot Machine(s) in California and in Florida.

- The parties will negotiate joint press releases and will schedule joint press conferences to be issued and held as soon as practicable after the first pilot Talking ATMs are installed in California and, thereafter, in Florida. If the parties cannot agree on the content of the joint press releases, either party may send their own press release, and schedule their own press conference, provided that (i) the content of the press release is consistent with this Agreement; and (ii) a copy of the release, and the time and location of the press conference, is communicated to all parties and their counsel at least forty-eight (48) hours before notification to the press.

12. Modification in Writing.

No modification of this Agreement by the parties shall be effective unless it is in writing and signed by authorized representatives of all the parties hereto.

13. Agreement Binding on Assigns and Successors; No Third Party Beneficiaries.

- 13.1 Assigns and Successors.

- This Agreement shall bind any assigns and successors of Bank of America and Council. Counsel shall be notified in writing within thirty (30) days of the existence, name, address and telephone number of any assigns or successors of Bank of America.

- 13.2 No Third Party Beneficiaries.

- The Settlement Agreement is for the benefit of the parties hereto only and no other person or entity shall be entitled to rely hereon, receive any benefit herefrom, or enforce against either party any provision hereof. The parties specifically intend that there be no third party beneficiaries to this Agreement, including, without limitation, the members of the Council.

14. Force Majeure.

The performance of Bank of America under this Agreement shall be excused during the period and to the extent that such performance is rendered impossible, impracticable or unduly burdensome due to acts of God, strikes or lockouts, unavailability of parts, equipment or materials through normal supply sources. If Bank of America seeks to invoke this Section, it shall notify Counsel in writing as soon as reasonably possible, specifying the particular action that could not be performed and the specific reason for the non-performance. Counsel and Bank of America will thereafter meet and confer regarding an alternative schedule for completion of the action that could not be performed, or an alternative action. Any dispute regarding the applicability of this Section, or any future action to be taken, that remains after the meet and confer session will be handled as a dispute pursuant to section 9 of this Agreement.

15. Integrated Agreement.

This Agreement and the Confidential Addendum executed concurrently herewith constitute the entire Agreement relating to the subject matters addressed therein.

16. Rules of Construction.

Each party and its legal counsel have reviewed and participated in the drafting of this Agreement; and any rule of construction to the effect that ambiguities are construed against the drafting party shall not apply in the interpretation or construction of this Agreement. Section titles used herein are intended for reference purposes only and are not to be construed as part of the Agreement. The Recitals are integral to the construction and interpretation of this Agreement and are therefore incorporated into this Agreement in their entirety.

17. Triplicate Originals/Execution in Counterparts.

All parties and Counsel shall sign three copies of this document and each such copy shall be considered an original. This document may be executed in counterparts.

PARTIES:

- BANK OF AMERICA

- CALIFORNIA COUNCIL OF THE BLIND

By: Catherine Skivers - DON BROWN

- NICAISE DOGBO

- BERNICE KANDARIAN

- JERRY KUNS

- ROGER PETERSON

APPROVED AS TO FORM:

- MORRISON & FOERSTER LLP

By: Arne Wagner, Esq., Attorney for Bank of America - SAPERSTEIN, GOLDSTEIN, DEMCHAK & BALLER

By: Linda M. Dardarian, Esq. - LAW OFFICES OF ELAINE B. FEINGOLD

By: Elaine B. Feingold, Esq. - DISABILITY RIGHTS EDUCATION AND DEFENSE FUND, INC.

By: Arlene Mayerson Esq.

Attorneys for Claimants